Given the uncertainty around future MEES (Minimum Energy Efficiency Standards) changes for commercial property, the most effective approach for landlords with large portfolios is to treat this as a strategic, long-term asset management and compliance risk, rather than a “wait until the regulations are confirmed” situation.

Here’s how we have helped our large portfolio clients break it all down into practical readiness steps so it links to life cycle planning, service charge budgeting, tenant relations, and lease strategy.

Strategic Planning = Higher Capital Values – Proactively aligning MEES upgrades with life cycle works, lease events, and tenant engagement not only avoids compliance risks but also enhances asset capital value.

- Future-proofed, energy-efficient properties command stronger yields, attract higher-quality tenants, and retain lender/investor confidence.

- Early action avoids last-minute contractor shortages and positions assets favourably in valuation and refinancing exercises.

Clear policies and procedures are essential for achieving EPC compliance 2027 and avoiding costly non-compliance risks.

Why 2027 Matters – Anticipating Policy Change

By 1 April 2027, all non-domestic privately rented properties in England and Wales are expected to need an EPC of C or better to be legally let; with EPC B targeted by 2030. While final regulations are yet to be confirmed, the government has made its trajectory clear: tighter exemptions, stronger enforcement, and greater alignment of EPCs with climate reporting and finance requirements.

Delay could mean:

- Stranded assets that cannot be re-let

- Loss of tenant retention opportunities

- Reduced asset valuations and borrowing power

Why act now?

- Avoid last-minute contractor and assessor bottlenecks

- Integrate EPC works into planned life cycle and refurbishment budgets

- Build MEES compliance into lease events, tenant negotiations, and CapEx forecasts

- Protect refinancing terms and meet investor ESG expectations

Market forces are already ahead of regulation.

Lenders are embedding EPC ratings into green loan pricing and refinancing approvals. Institutional investors scrutinise MEES compliance during acquisitions. Tenants increasingly view energy efficiency as part of occupancy cost and brand value.

Preparing for 2027 isn’t speculative; it’s risk mitigation and a strategic opportunity to futureproof portfolios.

Key Actions

- Portfolio-Wide Risk Assessment Now

- Audit EPC Ratings: Catalogue every asset with current EPC scores, date of assessment, and expiry date. Highlight those at C, D, E or lower as potential priority risk areas.

- Scenario Plan: Model the impact if the minimum rating was C by 2027 or B by 2030 (the most likely trajectories discussed in consultations).

- Identify “Quick Wins” vs. Major Works: Some improvements (LED lighting, controls, HVAC tuning) can be relatively low cost; others (building fabric upgrades, heat pump installation) require major capital planning.

- Integrate into Life Cycle & Capital Expenditure Planning

- Link MEES works to asset life cycle events: For example, align HVAC replacement, roof refurbishment, or cladding renewal with MEES improvement works to avoid duplication and rework.

- Create a MEES CapEx Forecast: Build a rolling 5–10 year budget with phased works so costs are spread and embedded into normal asset strategy, rather than treated as sudden compliance shocks.

- Consider “No Regrets” Works: Upgrades that will improve ratings regardless of future regulatory thresholds (insulation, high-efficiency plant, renewable integration) are safe bets.

- Occupier & Tenant Engagement

- Early Conversations: Discuss potential improvement works during regular tenant meetings. This can help with access, shared costs, and operational alignment.

- Demonstrate Shared Benefit: Energy efficiency upgrades reduce occupiers’ energy bills and improve comfort; present them as mutual value drivers, not just compliance costs.

- Data Sharing: Collaborate on sub-metering and monitoring so you can evidence savings and make a stronger case for investment.

- Lease & Legal Considerations

- Review Lease Clauses Now: Especially around access for works, service charge recovery, and tenant obligations for energy efficiency.

- Plan for Lease Events: Break clauses, lease renewals, and rent reviews are prime opportunities to build in MEES-aligned obligations (e.g., tenants must maintain certain performance standards).

- Avoid Stranded Assets: If you know a building may fail future MEES thresholds, factor in how this impacts lettability and valuation well before the lease event.

- Embed in ESG & Net Zero Strategies

- Tie MEES to ESG Reporting: Demonstrates proactive compliance and environmental stewardship to investors and lenders.

- Seek External Funding: Investigate government incentives, green loans, or sustainability-linked finance to support upgrades.

- Portfolio Optimisation: For hard-to-improve assets, assess whether disposal, redevelopment, or repurposing is a better option than heavy retrofit.

Bottom line:

Commercial landlords should start acting now; treat MEES not as a narrow compliance issue, but as a driver to future-proof assets, protect rental income, and align with wider net zero ambitions. The smartest operators are already integrating energy performance upgrades into their planned maintenance cycles and preparing leases that make future upgrades smoother, regardless of whether the minimum rating ends up at C, B, or beyond.

A readiness checklist helps businesses prepare for EPC compliance 2027, ensuring assets meet new energy efficiency standards.

MEES 2027 / 2030 Readiness Checklist – Incorporate this into your asset management strategy plans!

- Portfolio Assessment

- ☐ Catalogue EPC ratings, expiry dates, and underlying asset data for all properties

- ☐ Flag at-risk assets: EPC D or below (2027) and C or below (2030)

- ☐ Model compliance scenarios for EPC C by 2027 and EPC B by 2030

- Technical & Cost Planning

- ☐ Commission targeted energy assessments for at-risk properties

- ☐ Identify “quick win” improvements vs. major retrofit works

- ☐ Align MEES upgrades with planned life cycle works (HVAC, lighting, fabric)

- ☐ Develop a 5–10 year CapEx forecast with phased delivery

- ☐ Explore funding: green loans, government grants, energy performance contracts

- Lease & Legal Review

- ☐ Audit lease terms for access rights, service charge recovery, and improvement clauses

- ☐ Align MEES works with lease events (renewals, breaks, rent reviews)

- ☐ Add future EPC obligations into new and renewed leases

- ☐ Consider green lease provisions for ongoing performance

- Occupier Engagement

- ☐ Communicate MEES strategy and timelines to tenants early

- ☐ Collaborate on operational improvements that reduce EPC risk

- ☐ Share energy data and performance reporting to demonstrate benefits

- ☐ Negotiate works programmes to minimise disruption and maximise cost-sharing

- Risk & Opportunity Management

- ☐ Assess potential asset value impacts of non-compliance

- ☐ Identify disposal or redevelopment opportunities for poor-performing assets

- ☐ Incorporate MEES compliance into ESG reporting and investor updates

- ☐ Monitor legislative updates and adjust plans accordingly

Tip: Aim to complete portfolio-wide assessments and high-priority works planning by mid-2026 to avoid last-minute supply chain bottlenecks in 2027.

Achieving EPC compliance 2027 requires smart strategy, foresight, and proactive planning to protect asset value.

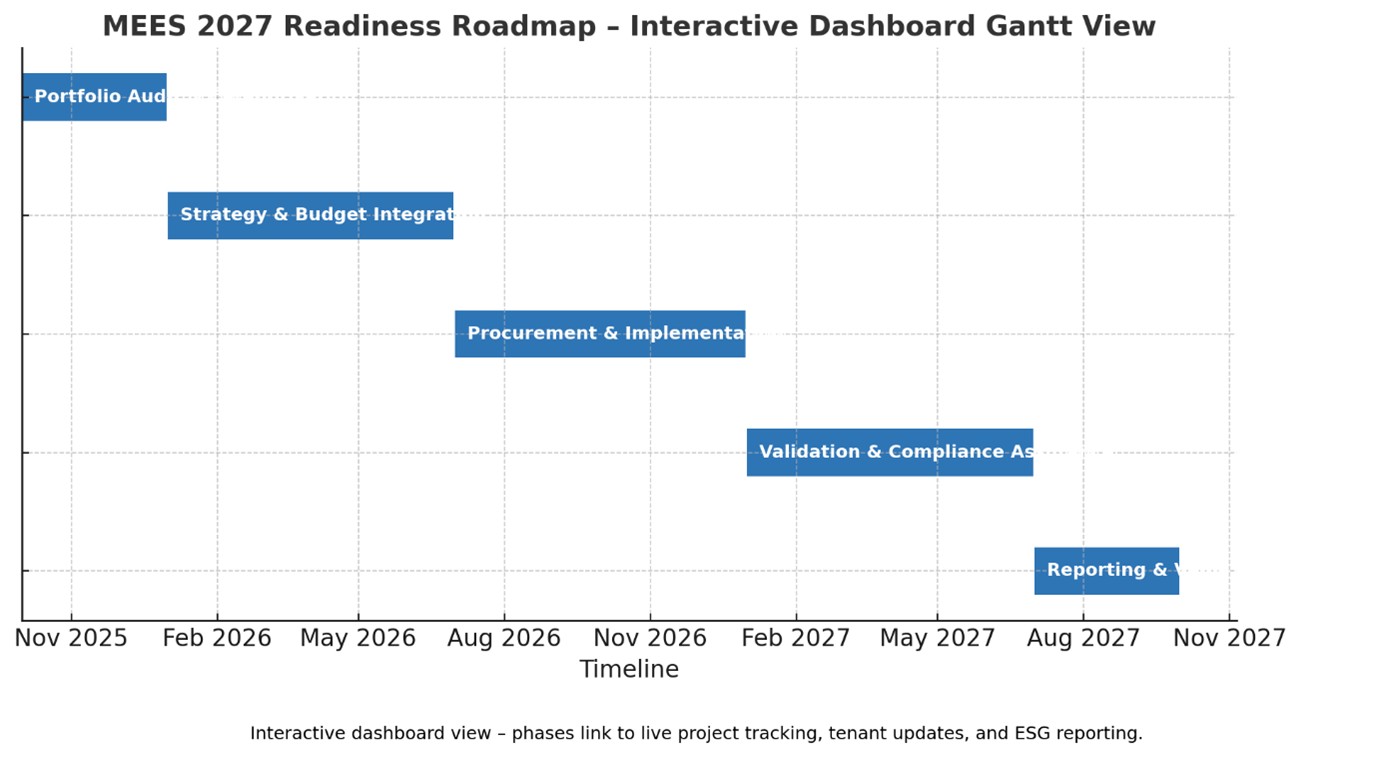

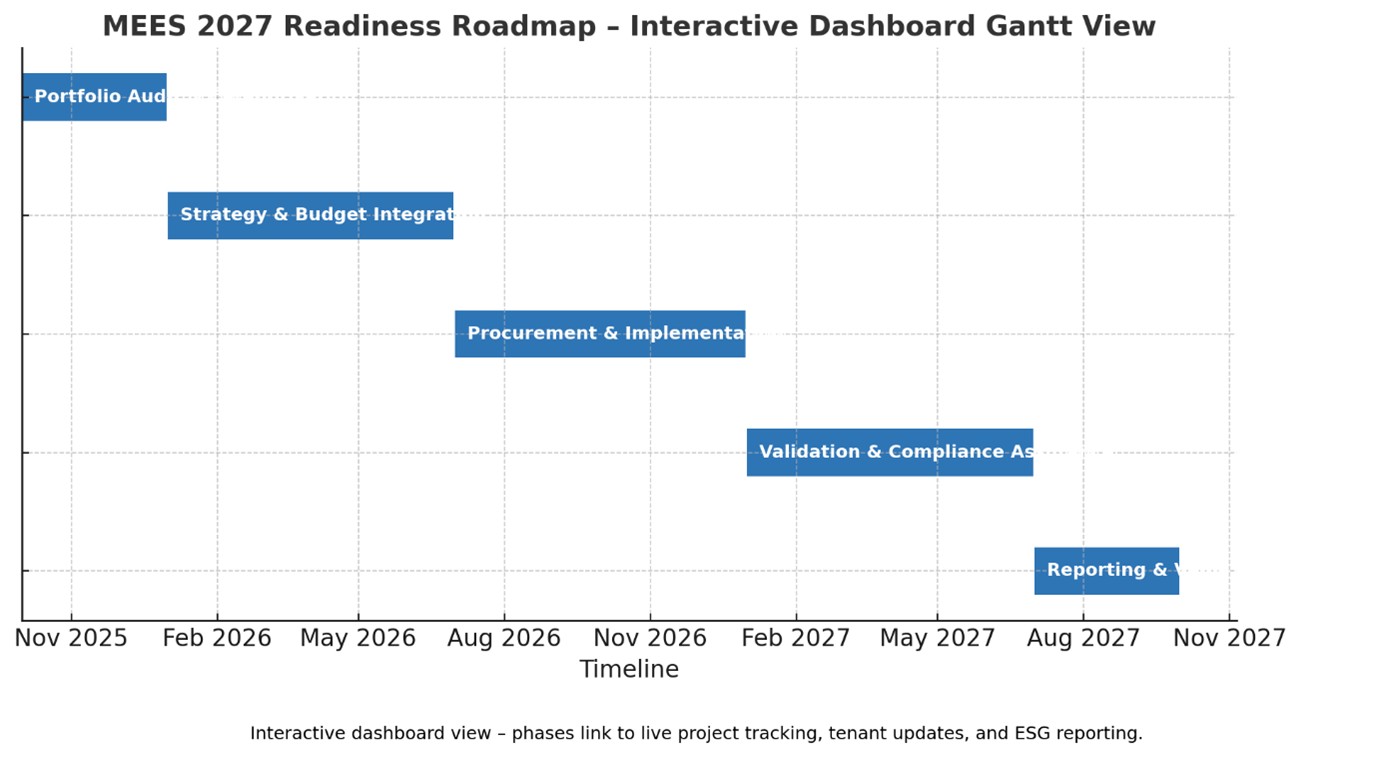

The EPC Compliance & De Risk Calendar – Planning from 2025 to 2027

To avoid MEES breaches, stranded assets, or tenant disputes, commercial property teams should use 2025–2027 to de-risk their portfolios. Here’s how to structure that timeline assuming a service charge period/ annual budget of between 1st January and 31st December:

The objective is to systematically phase audits, planning, works, and validation to ensure all properties are compliant by Q3 2027, while leveraging upgrades to enhance capital values, lettability, tenant satisfaction, and ESG performance.

Q4 2025 – Portfolio Audit & Categorisation

Activities:

- Appoint your EPC consultant

- Compile EPC ratings for all assets; prioritise those rated D, E, F, or G

- Cross-check EPC expiry dates, flagging those older than five years

- Identify where existing EPCs are likely inaccurate or outdated (using benchmarking and operational data comparisons)

- Categorise assets into compliance risk tiers:

- High risk: EPC F/G

- Medium risk: EPC D

- Lower risk: EPC C

- Map lease events (renewals, breaks, expiries, planned refurbishments) to create intervention windows

- Recommend targeted re-assessments to ensure accuracy

Reporting:

- Baseline compliance report issued to client, asset managers, and investors

- Tenant-facing communication pack prepared, explaining assessment visits and potential improvement works

- Highlight potential service charge implications under the updated RICS Code of Practice for Service Charges in Commercial Property

Q1–Q2 2026 – Strategy & Budget Integration

Activities:

- New EPC assessments for all medium- and high-risk assets (subject to asset strategy)

- Appoint technical consultants (M&E engineers, building surveyors) to scope options

- EPC consultant models costed upgrade measures – see below common upgrades works to achieve EPC B or C

- Develop a phased investment programme aligned with service charge recovery cycles and the client’s multi-year Capex plans

- Engage occupiers on potential service charge impacts; explore cost-sharing for efficiency measures linked to fit-out or refurbishment

- Prioritise assets with imminent lettings, refinancing, or revaluations

Reporting:

- Quarterly update to client management team with projected cost vs. value uplift

- Investor/lender briefing covering compliance trajectory and anticipated energy savings

- Tenant newsletter outlining co-benefits (lower energy bills, improved comfort, sustainability credentials)

Q3–Q4 2026 – Procurement & Implementation

Activities:

- Finalise detailed upgrade specifications, informed by energy modelling

- Tender across multiple workstreams to mitigate supply chain risks

- Commence upgrade works

- Update budgets and forecasts as required

- Schedule works in line with lease milestones or tenant occupation windows to minimise disruption

Reporting:

- Monthly progress dashboard to client, lenders, and ESG reporting teams

- Ongoing tenant liaison to confirm schedules, likely impacts, and site access requirements

Q1–Q2 2027 – Validation & Compliance Assurance

Activities:

- Commission new EPCs to validate post-upgrade performance

- Confirm improvements have achieved target ratings (EPC C or better)

- Update the MEES risk register to verify no remaining non-compliant assets

- Review leases impacted by MEES and update legal positions accordingly

Reporting:

- Compliance certificate packs for each property issued to client, occupiers, board, lenders, and legal teams

- Portfolio-wide MEES compliance statement prepared for inclusion in investor ESG reports and disclosures

Q3 2027 – Reporting, Positioning & Value Optimisation

Activities:

- Consolidate EPC and performance data within the asset management system

- Integrate results into GRESB, SECR disclosures, ESG reporting, and MEES compliance logs

- Position upgraded assets for green lease opportunities and preferential refinancing terms

- Document capital value uplifts in formal valuations, linked to improved EPC ratings

Reporting:

- Final MEES 2027 Readiness Report delivered to client, occupiers, and investors, highlighting CapEx invested vs. capital value achieved

- Tenant satisfaction survey results incorporated into programme review

- Press release and investor communications issued to reinforce market positioning as a sustainability leader

Expected Outcomes

- 100% portfolio compliance with proposed EPC thresholds ahead of the April 2027 deadline

- 7–10% uplift in capital values across improved assets

- Significant reduction in operational carbon emissions portfolio-wide

- Strengthened tenant retention and attraction rates through improved building performance

- Positive ESG ratings impact, enhancing access to sustainability-linked finance

Preparing your buildings today ensures smooth upgrades and protects asset value ahead of EPC compliance 2027.

Common Upgrade Packages to Achieve EPC C or B

Commercial buildings typically require a mix of fabric, building services, and operational improvements to lift EPC performance. The exact package depends on age, construction, and existing services, but the following interventions are most effective:

- Fabric & Envelope Improvements

- Roof, wall, and floor insulation – improves U-values and reduces heating/cooling loads, directly boosting EPC ratings.

- Glazing upgrades – double/triple glazing or secondary glazing systems, particularly effective in older stock.

- Air tightness works – sealing penetrations, installing draught-proofing, improving door sets.

- Solar control glazing / shading – reduces cooling demand in offices and retail.

EPC Impact: Upgrades here are long-life and generally provide modest uplift on their own, but when combined with efficient HVAC and lighting, they support a step-change from EPC D → C.

- Building Services

- Lighting:

- Replace fluorescent/halogen with high-efficiency LED systems.

- Add occupancy sensors and daylight dimming controls.

- Typical EPC uplift: one of the most cost-effective single measures.

- Heating & Cooling Systems:

- Gas-to-Electric Transition:

- Replacement of old gas boilers with air-source or ground-source heat pumps, or high-efficiency VRF/VRV systems.

- EPC methodology favours electric-based heating because the UK grid is decarbonising rapidly (carbon factor for grid electricity has fallen >70% since 2013).

- Even if operating costs are higher in the short term, EPC scores will rise substantially when moving away from fossil fuels.

- High-efficiency condensing boilers (if heat pumps are not feasible immediately).

- Hybrid solutions – combine boilers with heat pumps to manage peak loads.

- Ventilation & Air Handling:

- Replace inefficient AHUs with EC fans and variable speed drives.

- Install heat recovery ventilation (HRV) to capture waste heat.

- Renewable Integration:

- Solar PV feasibility studies – EPC ratings improve when on-site renewable energy offsets demand.

- Solar thermal (less common now but still improves hot water efficiency).

EPC Impact: Heating system replacement (especially moving from gas to electric) and lighting upgrades are often the largest single contributors to an EPC uplift from D → C or C → B.

- Operational & Controls

- Building Management System (BMS) Upgrades:

- Modern BMS with time scheduling, occupancy sensing, and demand-response capability.

- Load management for peak tariff avoidance.

- Zoning of HVAC – separate heating and cooling zones to reduce simultaneous demand.

- Smart Metering & Sub-Metering – enables monitoring by use type (lighting, heating, small power).

- Fault Detection & Diagnostics (FDD) – AI-driven or rule-based systems that optimise plant run times.

EPC Impact: EPC software credits control sophistication. Even modest interventions (e.g., adding zone controls) can shift an EPC by one band.

In Practice – From EPC D to C/B

- Properties with older EPCs often rely on default assumptions (e.g., no controls, poor insulation) that exaggerate inefficiency. Commissioning a new EPC after low-cost measures (LEDs, controls, smart meters) can sometimes move an asset one full band without major CapEx.

- To reach EPC B, however, most assets will need heating system electrification combined with envelope upgrades and intelligent controls.

Lease Clauses and Legal Triggers – What to Watch

Legal and financial risks grow as EPC standards rise. Landlords/ Investors should monitor how MEES obligations intersect with lease events and property law:

- Break Clauses:

- If a tenant vacates, the landlord may inherit liability for a non-compliant EPC before reletting.

- Strategy: tie in EPC upgrade works with lease breaks where possible.

- Service Charges:

- EPC upgrade costs may be partly recoverable, but landlords must comply with the RICS Service Charge Code of Practice.

- Transparency and early engagement with occupiers is essential to avoid disputes.

- Tenant Fit-Outs:

- Poorly specified tenant works (e.g., inefficient HVAC or lighting) can worsen EPC ratings.

- Strategy: include green lease clauses requiring fit-out to maintain or improve EPC performance.

- Reinstatement / Dilapidations:

- Lease-end reinstatement is often the most cost-efficient trigger point for EPC-related upgrades (e.g., boiler replacement or lighting rewiring).

- Consider specifying sustainable reinstatement obligations.

Bottom line:

- To future-proof portfolios for future MEES milestones , the most impactful pathway is:

Gas boiler replacement → Electric heat pumps/VRF + LED + BMS upgrades.

- Coupled with envelope works and smart lease planning, this maximises EPC uplift, minimises stranded asset risk, and strengthens capital values and ESG performance.