As we head towards 2026, one truth remains for UK businesses: energy is still one of the most unpredictable and influential costs on the balance sheet.

The combination of volatile wholesale markets, limited gas storage, and the UK’s dependence on imported energy means that even a single cold winter can have ripple effects that extend far beyond the heating season. For energy-intensive sectors; manufacturing, logistics, real estate, and data centres; this volatility can translate directly into pressure on operating margins, cash flow, and competitiveness.

But with the right procurement approach, monitoring systems, and risk strategy in place, businesses can protect themselves from winter price shocks; and even turn volatility into opportunity.

Understanding grid pressures and market volatility is essential for effective Energy Risk Management 2026.

The 2026 Energy Landscape: Cold Winters, Tight Supply, Rising Prices

While no one can predict the exact weather patterns for 2026, historical data shows that cold winters consistently drive price spikes across both gas and electricity markets.

Electricity demand peaks in winter when renewable generation is lower and gas storage levels are tight. Suppliers increasingly rely on gas-fired generation, which pushes wholesale prices upward.

During the 2022–23 winter, UK day-ahead electricity prices rose by more than 30% in just a few weeks as temperatures dropped and gas demand surged. Even with increased renewable generation, the UK remains heavily exposed to gas imports; particularly LNG; to balance supply.

In 2026, several structural factors could amplify that volatility:

Severe winter conditions continue to shape price volatility — reinforcing why Energy Risk Management 2026 is essential for UK businesses.

Commodity Costs Remain Volatile

Wholesale gas and electricity markets continue to be shaped by geopolitical uncertainty, supply constraints, and extreme weather. These factors make forward pricing unpredictable and expose businesses to sudden cost spikes.

To manage this volatility, organisations should consider hedging strategies, forward purchasing, or hybrid contracts that smooth out market peaks while retaining flexibility to capture savings when conditions allow.

Rising non-commodity costs demand smarter budgeting — and a stronger Energy Risk Management 2026 strategy.

Non-Commodity Costs Are Rising

Alongside wholesale price risk, non-commodity costs; including the Nuclear Regulated Asset Base (nRAB) levy, Transmission and Distribution (TNUoS/DUoS) charges, and environmental levies; are taking up an increasing share of total energy bills.

These costs are largely unavoidable but can be mitigated through accurate consumption data, capacity reviews, and tariff optimisation. A proactive approach to non-commodity management helps businesses limit exposure, protect margins, and plan budgets with greater confidence.

Put simply, a cold winter could still be very expensive.

In a shifting global energy landscape, Energy Risk Management 2026 is essential for protecting assets, budgets, and long-term sustainability goals.

Why Energy Strategy Matters More Than Ever

Energy is no longer a background cost; it’s a strategic lever. For many UK businesses, it now represents 5–20% of total operating costs.

For a company spending £1 million annually on energy, a 10% winter price spike equals an extra £100,000 in costs.

For larger industrial users spending £5 million, that same swing means £500,000; a direct hit to the bottom line.

Without a defined procurement strategy and risk framework, those swings can easily erase savings made elsewhere. That’s why leading organisations are shifting towards proactive, year-round procurement; combining smart timing, flexible contracting, and data-driven insight to manage risk in real time.

1 – Understand Your Energy Risk Profile

Before any procurement decision, you need clarity on how exposed your business is to market movement.

Ask yourself:

A clear risk profile helps match your procurement model to your tolerance:

For energy-intensive users, getting this balance right is the key to resilience.

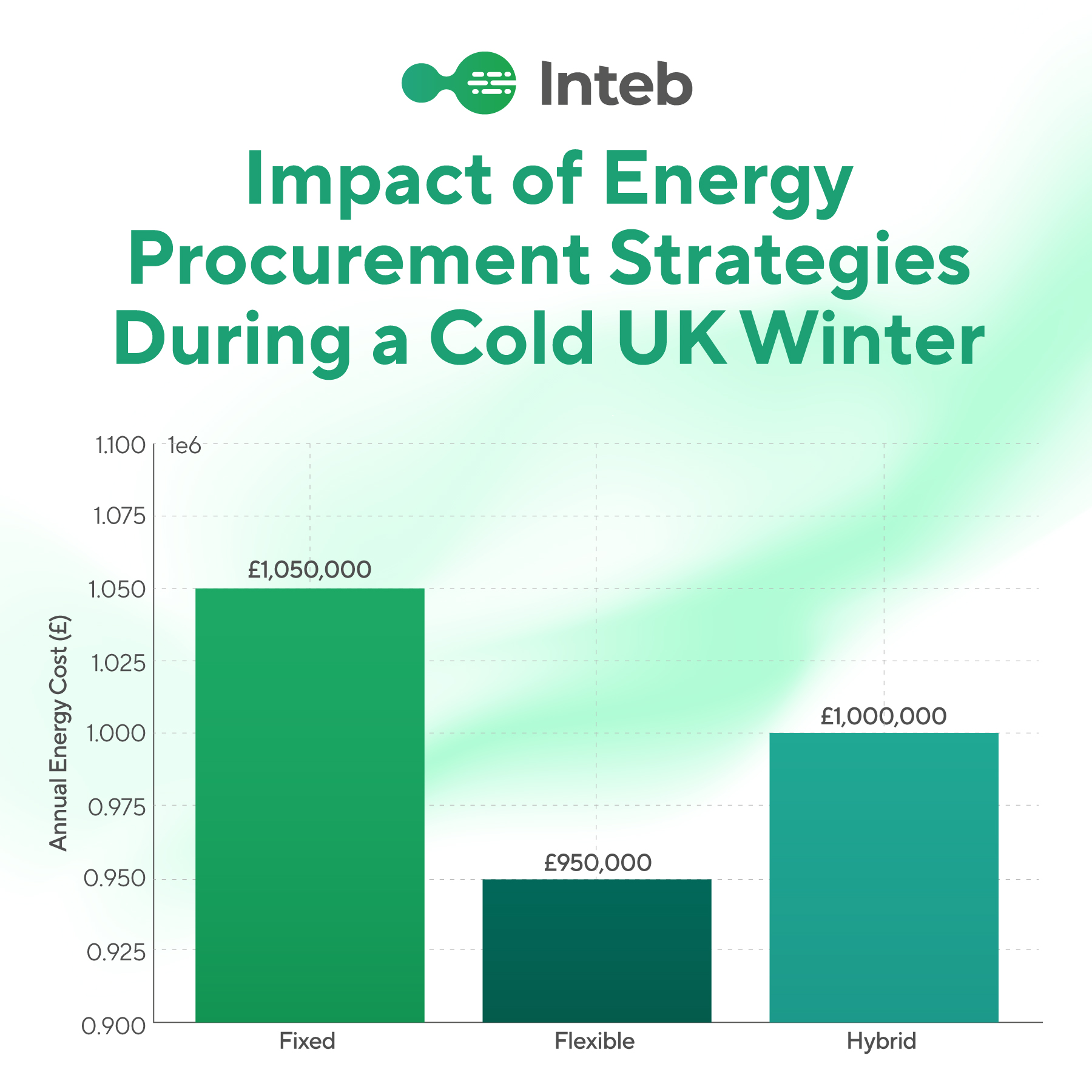

2 – Choose the Right Procurement Strategy

There’s no single “best” model; only the one that fits your business goals, market exposure, and operational flexibility.

Fixed Contracts

Provide budget certainty for a set period.

Flexible Procurement

Buy energy in tranches over time to spread risk and capture market dips.

Hybrid Models

Blend fixed and flexible elements for balanced protection and opportunity.

3- Monitor Market Signals Year-Round

In a cold winter, market awareness is everything. Businesses that treat procurement as a once-a-year task miss opportunities.

Effective procurement relies on continuous intelligence:

Companies with structured monitoring frameworks can fix, flex, or hold positions with confidence as conditions evolve.

4 – Reduce and Shift Demand

Even the best procurement strategy can’t eliminate risk entirely, but reducing and reshaping demand can significantly cushion winter price impacts.

Practical steps:

A 5–10% efficiency gain can deliver the same bottom-line benefit as a 5–10% price reduction; with less exposure.

Forecasting and Load Management Are Critical

Accurate forecasting and effective load management are now essential for energy resilience.

By using data to predict demand patterns and shifting non-critical activity to lower-tariff periods, businesses can reduce costs and avoid peak-time surges.

Adding on-site generation and storage; such as solar, CHP, or batteries; further reduces reliance on the grid and buffers against volatility during peak winter demand.

5 – Leverage On-Site Generation

On-site generation is no longer just a sustainability measure; it’s a hedge against volatility.

Technologies like solar PV, combined heat and power (CHP), and battery storage can:

Integrating generation with procurement; e.g. fixing imported volumes while flexing surplus; helps smooth costs and strengthen resilience through peak periods.

6 – Engage Expert Support

In today’s volatile market, even experienced finance or procurement teams benefit from specialist insight.

Energy consultants and brokers can:

As 2026 approaches, those who combine internal governance with external expertise will be best placed to stay ahead.

This chart demonstrates why Energy Risk Management 2026 is critical — flexible procurement outperforms fixed and hybrid strategies during a cold UK winter.

The Bottom Line: Turning Risk into Resilience

Energy is no longer a passive cost; it’s a strategic lever for performance, sustainability, and competitiveness.

By understanding risk, selecting the right structure, and integrating flexibility and efficiency, UK businesses can:

Even small strategic improvements can yield six-figure savings for large users; directly improving financial resilience.

In short, proactive planning today equals financial stability tomorrow.

Have questions about energy costs this winter? Strong Energy Risk Management 2026 planning ensures businesses stay protected through volatility.

How Inteb Helps Businesses Manage Energy Risk

At Inteb, we work with clients across sectors to design robust, data-driven energy procurement strategies that balance timing, cost, and carbon.

We help businesses to:

With decades of trading and market expertise, we help clients turn volatility into visibility; enabling them not just to withstand price shocks, but to thrive through them.

Talk to our experts: weareinteb.co.uk/contact