Usually, you’d finish a blog with some good news, but as I want to stick to the Sergio Leone 1966 film template, I’ll begin with The Good.

The Good

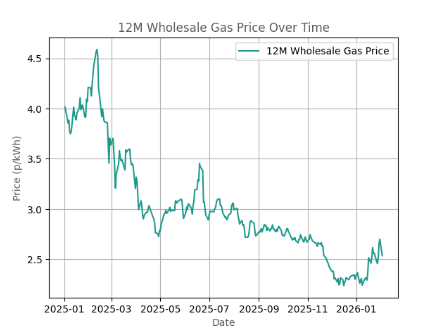

Wholesale Gas prices have fallen since 1st January 2025 due to the availability of global LNG. After relative stability toward the end of last year, market volatility has re-entered the picture over the last month due to escalations in geopolitics. The wholesale trading price during w/c 26th January 2026 deviated 0.109p/kWh, it’s most volatile week since 23rd June 2025.

As you continue reading, I will be commenting on rising energy costs, however there are opportunities to reduce your energy bill from reducing consumption, reviewing your supply capacity, signing up to a Half Hourly matching product that includes exemptions from several Third Party charges or consider flexible purchasing. If your annual consumption is less than <2GWh then consider joining a flex group basket approach.

Inteb have saved our client’s hundreds of thousands of pounds in Standing Charges by reducing their authorised supply capacity enough to fall into a lower band of Targeted Charging Reforms (TCR). The Network Operators can only update the supply capacity once a year and will always advise to approach with caution as additional capacity may not be available should you require it further down the line and may put off prospective buyers if the meter load is too small.

The Bad

Non-Commodity energy costs are increasing until at least 2031, according to the latest published forecasts by the system operator, National Energy.

The old ways of decarbonising the grid, such as the Renewable Obligation and Feed in Tariff scheme, have been supported by successive Governments over the last 20 years, with the aim of encouraging consumers to switch to renewable generation through financial incentives. Those who signed up early received both funding and subsidies linked to higher RPI (Retail Prices Index) inflation measures, meaning they got considerable payouts for exporting back to the grid. From April 2026, subsidy payments under these schemes will be linked to CPI (Consumer Prices Index) and we forecast that these charges will be eventually phased out toward the back end of the 2020s.

New ways to help assist in build and maintain the infrastructure to support the transition to a greener network will be factored into your contracts. The Energy Intensive Industry (EII) Support Levy has been factored into your electricity contract from April 2024 and equates for 0.15p/kWh of your unit rate. The charge has been designed to alleviate financial pressure from energy intensive business to make sure they are still able to operate and compete in a global market. The Nuclear RAB levy is a government initiative designed to help fund development of new nuclear power stations in the UK, which will have been factored into your electricity contract from 1st December 2025, ranging from 0.345-0.5p/kWh depending on contract length.

The Ugly

Ofgem five-year projections for the Transmission Network (TNUoS) indicate a significant rise in costs from April 2026, with an estimated £70 billion required over the next five years for investment in and maintenance of the electricity network. These costs are expected to increase in the region of 90 -100% compared to 2025/26 charges putting a noticeable upward pressure on consumer standing charges.

Please get in touch if you would like a bespoke 5-year non-commodity forecast for your electricity meter