For many commercial property owners, managing agents, and procurement teams, 2026 has brought an uncomfortable realisation.

Energy prices have not surged in the way they did during the market volatility of 2022 and 2023. Wholesale electricity prices look relatively stable by comparison. Yet total energy bills continue to rise. Budgets are under pressure. Service charge conversations are becoming more difficult. And many organisations are struggling to explain why.

The answer sits outside the unit rate.

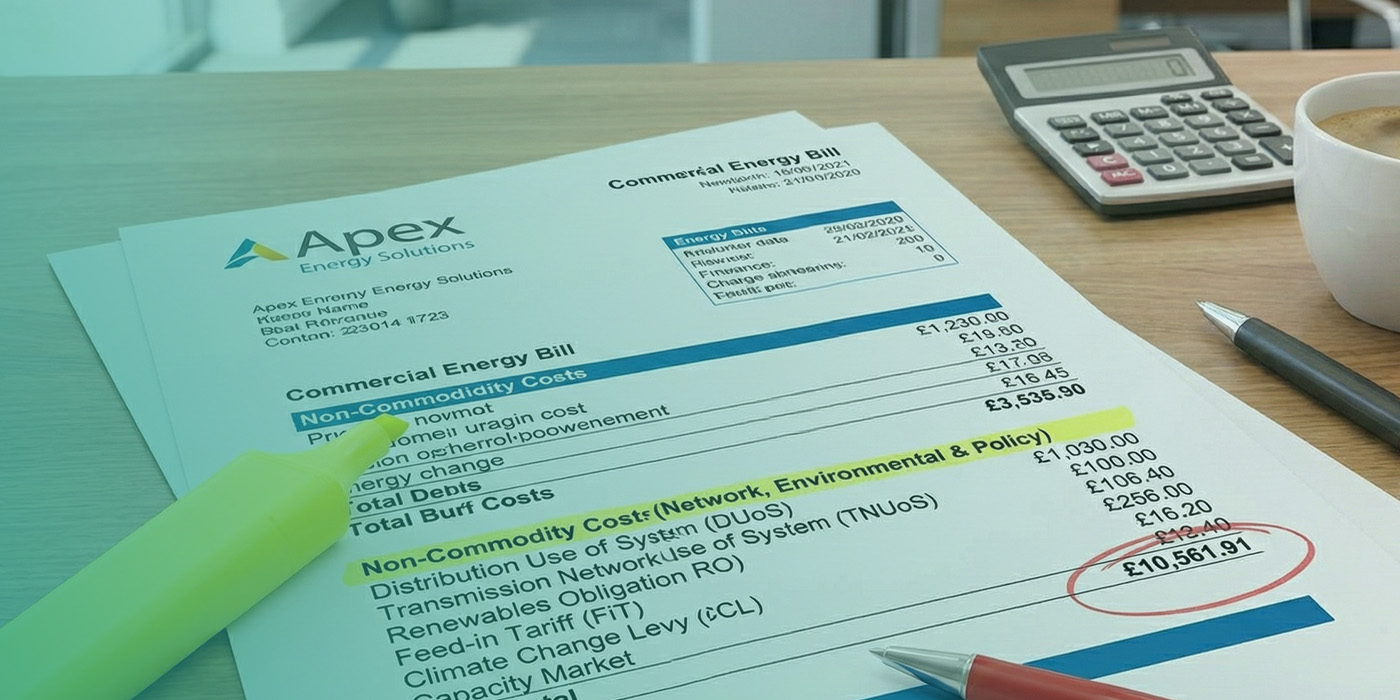

In 2026, the biggest driver of electricity cost for large users is no longer the commodity price. It is the rapid growth of non-commodity charges. Transmission and distribution costs. Balancing and system charges. Capacity Market costs. Environmental and social levies. And now, the full impact of the Nuclear RAB Levy.

For many multi-site portfolios, these charges now account for 60 to 70 percent of the total electricity bill.

This is the real budget shock of 2026.

Non-commodity energy costs 2026 are catching many organisations off guard during budget reviews.

Why This Has Caught So Many Organisations Out

Most energy budgets are built around a familiar assumption.

If we fix the price, we control the cost.

That assumption no longer holds.

Fixed price contracts signed in 2025 and earlier have delivered price certainty on wholesale electricity. But many of those contracts passed non-commodity costs straight through to the customer. Others indexed them. Some allowed new levies to be added mid-contract.

At the time, these clauses attracted little attention. Non-commodity charges were seen as background noise rather than a material risk.

In 2026, they have become the dominant cost driver.

As a result, many organisations are seeing higher bills despite stable unit rates. Not because suppliers have increased prices, but because the underlying cost stack has changed.

A closer look at how Non-commodity energy costs 2026 now dominate commercial energy bills.

What Are Non-Commodity Costs, Really

Non-commodity costs are everything on an electricity bill that is not the wholesale cost of power itself.

They exist to fund the infrastructure, security, and policy objectives of the energy system. In 2026, these include:

Transmission Network Use of System charges, known as TNUoS

Distribution Use of System charges, known as DUoS

Balancing Services Use of System costs

Capacity Market charges

Environmental and social levies

The Nuclear Regulated Asset Base levy

Other policy and system charges

For years, these costs sat in the background. In many budgets they were estimated using historic averages. In some cases, they were barely scrutinised at all.

That approach is no longer viable.

Major grid and infrastructure works highlight what has changed in Non-commodity energy costs 2026.

What Has Changed in 2026

Several structural shifts have converged at the same time.

First, the UK energy system is undergoing significant network reinforcement. Investment is required to support electrification, renewables, and the transition away from fossil fuels. Those costs are recovered through network charges.

Second, the move into the RIIO-3 regulatory framework has changed how network costs are set and recovered. Transmission and distribution charges have increased materially for many large users, particularly those with high peak demand or poorly optimised profiles.

Third, the Nuclear RAB Levy is now fully embedded. Sizewell C is no longer a future concept. It is a live cost sitting within electricity bills, and it will remain there for decades.

Fourth, Capacity Market costs are rising as the system faces increasing security of supply pressures. Reduced dispatchable generation and higher peak demand mean capacity is more valuable, and more expensive.

Finally, market wide half hourly settlement is increasing exposure to peak periods and consumption behaviour. For portfolios without accurate data or load visibility, this adds another layer of risk.

Individually, each of these changes might be manageable. Together, they are reshaping the entire cost structure of electricity.

Why fixed contracts are colliding with rising Non-commodity energy costs 2026.

Why Fixed Contracts Signed in 2025 Are Now Exposing Risk

Many fixed contracts signed in 2025 were procured in good faith. Prices were competitive. Budgets were agreed. Boards were reassured.

What is now becoming clear is that many of those contracts transferred non-commodity risk directly to the customer.

Common issues we see include:

Pass through clauses for new or expanded levies

Indexation of network and policy costs without caps

Capacity Market charges passed through mid-contract

Limited transparency on how non-commodity costs are calculated

Budget models based on outdated assumptions

In effect, price risk was fixed, but system risk was not.

For multi-site portfolios, the impact is amplified. Small increases at individual sites quickly add up. Variance is harder to spot. Overspend becomes embedded before it is fully understood.

The service charge challenge created by rising Non-commodity energy costs 2026.

The Service Charge Challenge

For property managers, non-commodity cost increases create a very specific problem.

These costs are real. They are unavoidable. And they are often difficult to explain to occupiers.

Tenants see stable prices in the media and assume energy costs should be under control. When service charges increase, trust is strained. Disputes become more common. Transparency is questioned.

Without a clear understanding of non-commodity costs, it becomes difficult to demonstrate good energy management, even when procurement decisions were reasonable at the time.

This is why 2026 has become such a challenging year for service charge recovery.

Why Budgets Are So Often Wrong

In many organisations, energy budgets are still built using historic templates.

They assume non-commodity costs remain broadly flat. They do not model peak demand exposure. They do not stress test contract clauses. They do not reflect portfolio level behavioural change.

As a result, budgets look sensible on paper but fail in practice.

When the year unfolds, finance teams are left managing variance rather than controlling cost. Procurement teams are asked why savings have not materialised. Property teams are pulled into reactive conversations.

None of this is due to poor intent. It is due to a structural shift that many organisations have not yet adapted to.

What better energy budgeting looks like when Non-commodity energy costs 2026 are properly understood.

What Better Energy Budgeting Looks Like in 2026

In 2026, good energy budgeting requires a different approach.

It starts with accepting that non-commodity costs are not secondary. They are central.

That means:

Using forward looking network charge forecasts

Understanding site and portfolio peak demand exposure

Reviewing contract clauses in detail, not just price

Aligning budgets with real consumption data

Separating commodity and non-commodity risk clearly

For large users, this often requires specialist support. Not because the information is unavailable, but because it is complex, fragmented, and constantly changing.

How Inteb Supports Clients Through This Shift

At Inteb, we are increasingly supporting clients with non-commodity cost analysis, forecasting, and risk management.

This includes:

Breaking down electricity bills in plain English

Identifying where non-commodity exposure sits within contracts

Reviewing pass through clauses and indexation mechanisms

Supporting realistic budgeting for 2026 and beyond

Helping property teams explain costs clearly to stakeholders

The goal is not to eliminate non-commodity costs. That is not possible. The goal is to understand them, anticipate them, and manage them intelligently.

The Bigger Picture

The rise of non-commodity costs is not a temporary issue. It is structural.

Grid investment will continue. Levies will expand. Capacity requirements will grow. Electrification will increase peak demand.

For large users, this means energy procurement can no longer be treated as a transactional exercise. It is now a strategic financial decision with multi-year implications.

Those who adapt early will protect budgets, reduce disputes, and maintain credibility with occupiers and stakeholders.

Those who do not will continue to experience budget shock, even in periods of stable pricing.

Have more questions about energy budgeting as Non-commodity energy costs 2026 continue to rise.

Final Thoughts

The real budget shock of 2026 is not about wholesale electricity prices.

It is about everything else.

Non-commodity costs now dominate the bill. Fixed contracts signed with incomplete understanding are exposing hidden escalations. And many organisations are only now realising how much risk has been transferred to them.

Energy cost control in 2026 starts with visibility, understanding, and planning.

Price still matters. But structure matters more.

At Inteb, we help organisations navigate this new reality with clarity, insight, and practical advice grounded in how energy actually works today.

If your budgets feel under pressure despite stable prices, the answer is almost certainly sitting in your non-commodity costs.